Alcohol duty in the UK has been frozen since February 2019, but in March this year the government announced that this is to change as of 1st August 2023 when their new duty legislation will go live.

The aim of this new legislation is to create standardised alcohol duty bands across all types of producer, (beer, spirits, cider, still and sparkling wines, as well as other fermented beverages), with all tax rates calculated based on the litres of pure alcohol in the product. This will reduce the number of tax bands from 15 to 8, but does represent the biggest change that the UK alcohol industry has experienced since 1975.

Recognising that these changes will have a significant impact on the wine industry, the government has put in place a transitional period that begins on 1st August 2023 and ends 31st January 2025. During this period, all still and sparkling wines between 11.5% and 14.5% ABV should use an ‘assumed’ strength of 12.5% ABV when calculating duty to make it easier.

What does this mean for your business?

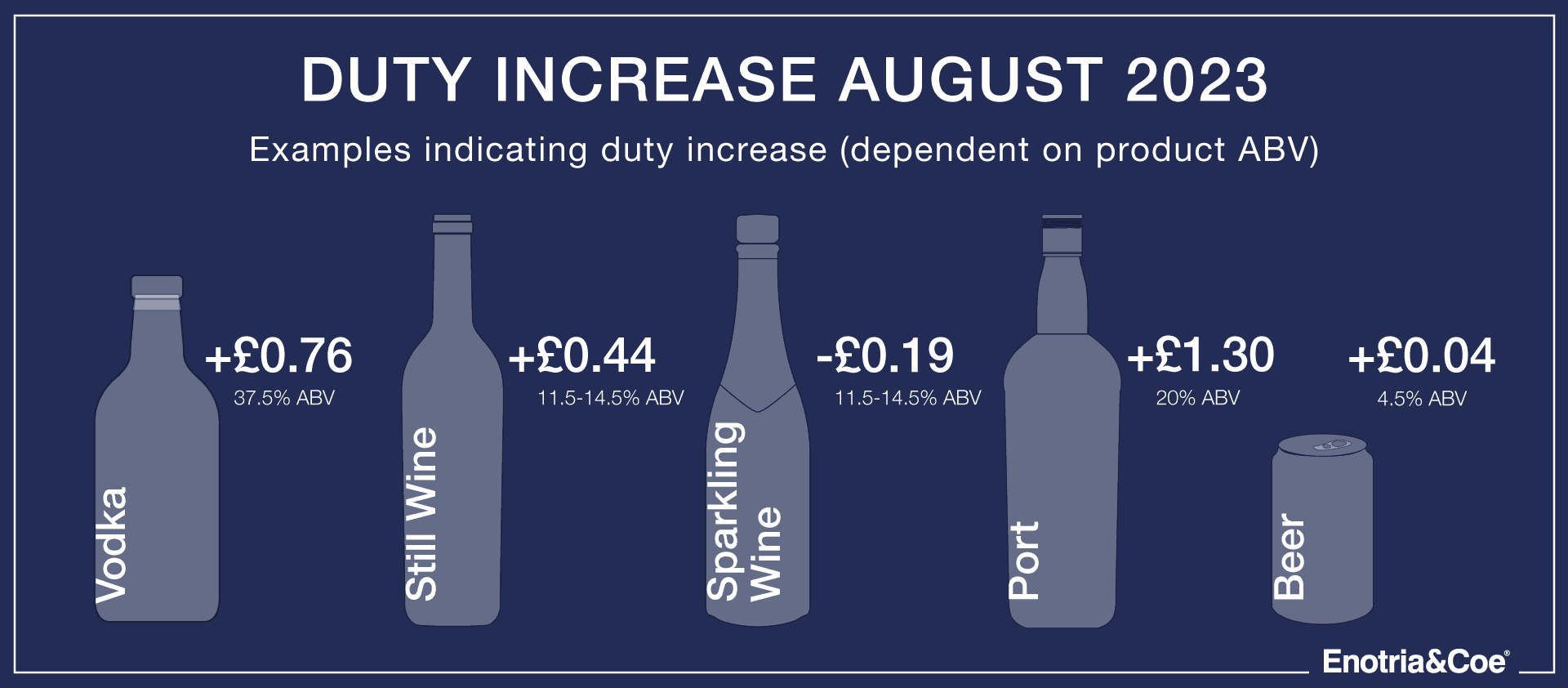

Duty on still wines will increase, most by £0.44 per 75cl bottle, and the duty on sparkling wines below 15% ABV, will be decreasing by at least £0.19 per 75cl bottle1st August. In summary:

Wine

| ABV | Current Duty per Bottle (75cl) | Duty from 1st August 2023 (75cl) | Difference | ||

|---|---|---|---|---|---|

| Still | Sparkling | Still & Sparkling | Still | Sparkling | |

| 8.5% | £2.23 | £2.86 | £1.82 | -£0.41 | -£1.04 |

| 9% | £2.23 | £2.86 | £1.92 | -£0.31 | -£0.94 |

| 9.5% | £2.23 | £2.86 | £2.03 | -£0.20 | -£0.83 |

| 10% | £2.23 | £2.86 | £2.14 | -£0.09 | -£0.72 |

| 10.5% | £2.23 | £2.86 | £2.24 | +£0.01 | -£0.62 |

| 11% | £2.23 | £2.86 | £2.35 | +£0.12 | -£0.51 |

| 11.5%-14.5%* | £2.23 | £2.86 | £2.67 | +£0.44 | -£0.19 |

| 15% | £2.23 | £2.86 | £3.21 | +£0.98 | +£0.35 |

* All still and sparkling wines between 11.5% and 14.5% ABV should use an ‘assumed’ strength of 12.5% ABV until 1st February 2025

Wine

| Current Duty | Duty from 1st August 2023 | Difference | |

|---|---|---|---|

| Vodka (37.5% ABV, 70cl) | £7.54 | £8.31 | +£0.76 |

| Pre-mixed Gin & Tonic (5% ABV, 25cl) | £0.36 | £0.31 | -£0.05 |

| Sherry (15% ABV, 75cl) | £2.23 | £3.21 | +£0.97 |

| Port (20% ABV, 75cl) | £2.98 | £4.28 | +£1.30 |

| Canned Cider (4.5% ABV, 44cl) | £0.18 | £0.19 | +£0.01 |

| Draught Cider (4.5% ABV, 57cl/pint) | £0.23 | £0.22 | £0.00 |

| Canned Beer (4.5% ABV, 44cl) | £0.38 | £0.42 | +£0.04 |

| Draught Beer (4.5% ABV, 57cl/pint) | £0.49 | £0.49 | £0.00 |

Your options ahead of 1st August?

- Apply the duty increase on 1st August and update your wine lists or retail prices accordingly ahead of the deadline.

- Build-up stock inventory of faster moving lines ahead of July 31st 2023 to delay the price increase until September and review menus and retail offerings then.

- Depending on your sales mix, keep prices on menus the same until post the busy summer period if sparkling wines savings will offset the duty increase on still wines.

- Make changes to your offering ahead of 1st August to include more lower alcohol wines, beers and spirits on your lists.

What can we do to help?

Your Account Manager is there to help as much as possible with this transition. Please do reach out to them if you have any questions. The business is working with suppliers to provide some cost savings opportunities to mitigate duty increases on selected lines.

We will be able to advise on the best course of action for your business and outline more detailed support that we can provide in the coming months to ensure minimal disruption.

We are also looking at other processes that Enotria&Coe can put in place to further support you in the lead up to 1st August and will update further on this shortly.

“Enotria&Coe were instrumental in developing ‘WineDrinkersUK’ which attempted to influence the Government on behalf of the wine industry. Despite our best efforts, the Government hasn’t been as helpful as we had hoped towards the hospitality industry, not only throughout COVID-19, but now with the additional stresses of ever-increasing inflation and now the duty regime. We can, however, see that consumers remain willing to spend their hard-earned money on great products and experiences. The UK is forecasted to avoid a recession, UK hospitality is driving a large proportion of the country’s job growth, and we believe despite this obstacle, there is a bright future - and we are here to help you be successful.” – Troy Christensen, CEO

For more information, please visit the government website.